Within the digital age, technology proceeds to reshape different viewpoints of our lives, counting the way we make installments. Mobile payments have risen as a helpful and secure elective to traditional payment strategies, such as cash and cards. With the broad selection of smartphones and mobile apps, this frame of payment has picked up notoriety over the globe. This article investigates the concept of mobile payments, their points of interest, prevalent mobile payment stages, and their affect on long run of transactions.

Understanding Portable Payments

Mobile payments refer to transactions made utilizing a portable gadget, frequently a smartphone or a tablet, to exchange stores or make buys. Instead of utilizing physical cash or cards, clients can utilize portable installment apps and organizations to add up to cash related exchanges consistently. This development utilizes near-field communication (NFC), QR codes, or digital wallets to encourage secure and helpful payments.

Focal points of Versatile Payments

Mobile installments offer a few focal points that have contributed to their growing popularity:

Convenience: Mobile installments eliminate the need to carry cash or multiple cards. With a smartphone, users can make installments anytime, anywhere, as long as they have an internet connection.

Speed and Productivity: Mobile installments give a faster and more efficient checkout process compared to traditional strategies. With a straightforward tap or check, transactions are handled in seconds, reducing holding up times at checkout counters.

Security: Versatile installment stages prioritize security by utilizing encryption and tokenization strategies. These measures guarantee that delicate installment information is defended, decreasing the hazard of extortion or unauthorized access.

Contactless Exchanges: Versatile installments bolster contactless exchanges, which have gotten to be especially pertinent within the wake of the COVID-19 widespread. Clients can make installments without physical contact, minimizing the spread of germs and advancing a clean installment experience.

Digital Record Keeping: Portable installment apps give advanced receipts and exchange history, allowing users to track their costs more proficiently. This includes rearranges budgeting and cost management.

Well known Portable Installment Platforms

Several portable installment stages have picked up noteworthy footing within the advertisement. Here are three prevalent options:

Apple Pay is Apple’s versatile installment and advanced wallet benefit. It allows clients to form installments utilizing their iPhone, iPad, Apple Watch, or Mac gadgets. Apple Pay supports NFC technology for contactless payments and is congruous with various banks and merchants.

Google Pay, developed by Google, enables users to create installments through their Android gadgets. It underpins NFC exchanges and coordinates with Google’s environment, making it easy to interface installment methods and get devotion cards. Google Pay also facilitates online and in-app payments.

Samsung Pay may be a mobile payment solution offered by Samsung. It bolsters both NFC and attractive secure transmission (MST) advances, permitting clients to create payments at both NFC-enabled and conventional magnetic stripe terminals. Samsung Pay is compatible with select Samsung devices.

Versatile Installments and Security

Security may be a pivotal viewpoint of portable installments, and critical measures are in put to ensure client information:

Encryption: Portable installment stages utilize encryption procedures to secure client information amid transmission. This guarantees that installment subtle elements are safely transmitted and ensured from unauthorized access.

Tokenization: Tokenization replaces sensitive payment data, such as credit card numbers, with unique tokens. These tokens are used for transactions, diminishing the chance of data theft or interception.

Biometric Verification: Many portable payment apps join biometric authentication methods, such as unique mark or facial acknowledgment, to upgrade security. These authentication methods include an additional layer of protection by ensuring that as it were authorized users can make payments.

Long Run of Versatile Payments

The future of mobile payments is promising, with a few trends forming the landscape:

Widespread Adoption: As smartphones ended up more ubiquitous all inclusive, the adoption of mobile installments is anticipated to increase. More clients will grasp this helpful and secure payment strategy, driving to a move absent from traditional installment options.

Integration with IoT Gadgets: The Internet of Things (IoT) will play a part within the extension of portable installments. Associated gadgets, such as smartwatches, wellness trackers, and even domestic appliances, will integrate payment capabilities, allowing for seamless and robotized transactions.

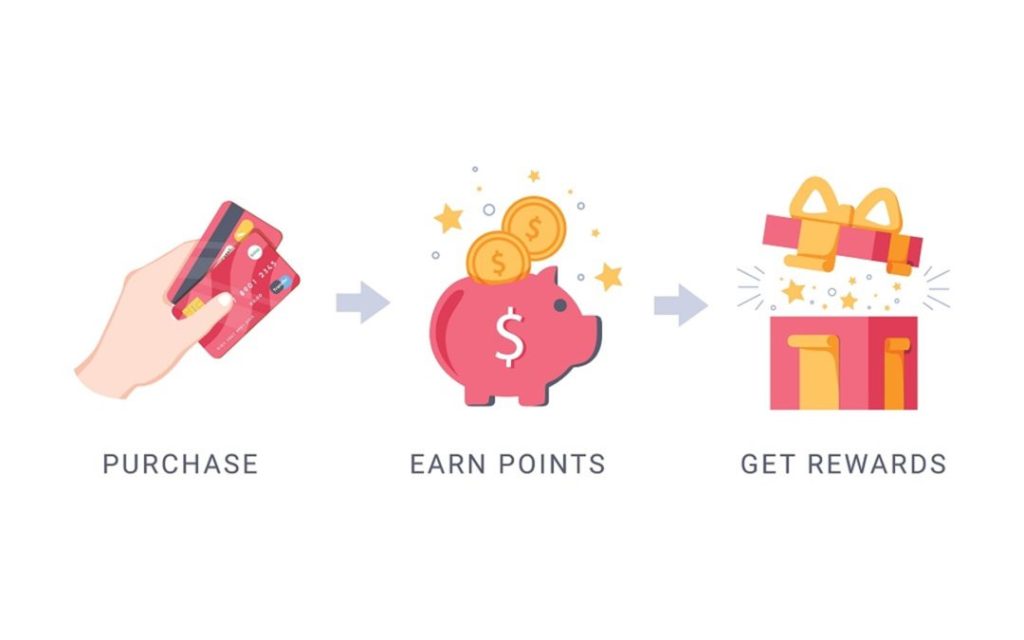

Enhanced Personalization: Mobile installment stages will continue to use information analytics to offer personalized suggestions and dependability programs. Users can anticipate tailored offers and rewards based on their investing habits and preferences.

Blockchain Innovation: The use of blockchain innovation in mobile installments can enhance security, transparency, and efficiency. Blockchain-based mobile installment solutions have the potential to revolutionize cross-border transactions and disentangle settlement processes.

Conclusion

Mobile payments have revolutionized the way we execute by giving a convenient, secure, and effective installment arrangement. With the broad adoption of smartphones and the continuous advancements in technology, mobile installments are balanced to reshape long-standing exchanges. As users grasp the benefits of comfort, speed, and security, portable payment stages will proceed to innovate and expand their offerings.

Frequently Inquired Questions (FAQs)

How do mobile installments work?

Mobile payments utilize portable gadgets and payment apps to facilitate transactions. Clients can tap, check, or utilize computerized wallets to form payments safely and conveniently.

Are versatile installments secure?

Yes, mobile payments prioritize security through encryption, tokenization, and biometric authentication. These measures ensure client data and guarantee secure transactions.

Which versatile installment stages are popular?

Popular portable installment stages incorporate Apple Pay, Google Pay, and Samsung Pay.

Can versatile installments be utilized for online purchases?

Yes, versatile installments can be used for online buys. Mobile installment apps provide a secure and convenient way to total transactions inside apps and on websites.

What does the longer term hold for portable payments?

The future of versatile installments involves far reaching adoption, integration with IoT devices, enhanced personalization, and the utilization of blockchain innovation for secure and efficient exchanges.