GDP (Gross Domestic Product or Gross Domestic Product) could be a degree of a country’s financial execution and speaks to the entire esteem of all merchandise and administrations created by a country in a given period (as a rule a year). It is considered one of the foremost critical pointers of a country’s financial wellbeing and growth.

GDP is calculated utilizing one of the taking after methods:

Output Approach: This strategy includes calculating the GDP by including the esteem of all products and administrations created in a country.

Income Approach: This strategy includes calculating the GDP by including all the salary earned by people and businesses in a country.

Expenditure Approach: This strategy includes calculating the GDP by including up all the investing on products and administrations by customers, businesses, and the government.

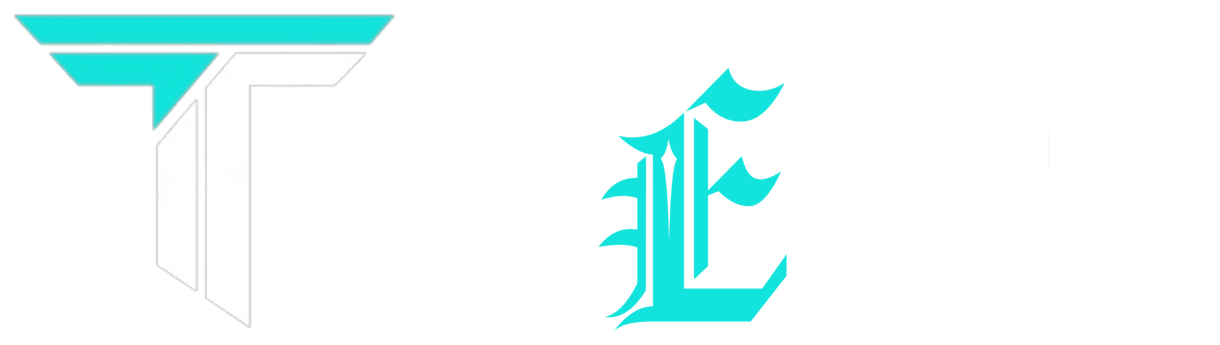

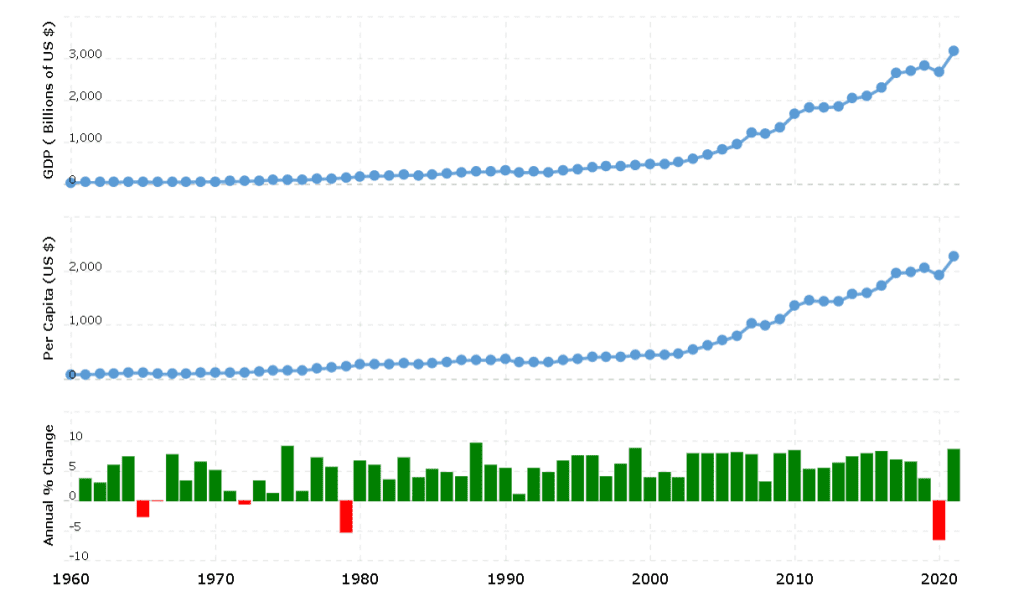

Asian Improvement Bank (ADB) anticipates India’s gross domestic product (GDP) development to moderate to 6.4% in monetary year (FY) 2023 finishing Walk 31, 2024, and rise to 6.7% in FY 2024 Govt moves forward transportation Arrangement bolster for foundation, coordinations and trade environments.

The forecast is part of the latest edition of ADB’s flagship economic publication, the April 2023 Asian Development Outlook (ADO), released today.Slower growth in India in FY2023 is predicated on a continued slowdown in the global economy, tighter monetary conditions and higher oil prices. However, according to ADO April 2023 data, investment is expected to grow faster in FY2024 due to supportive government policies and sound macroeconomic fundamentals, a reduction in bank non-performing loans and a sharp corporate deleveraging that will increase bank lending.

|

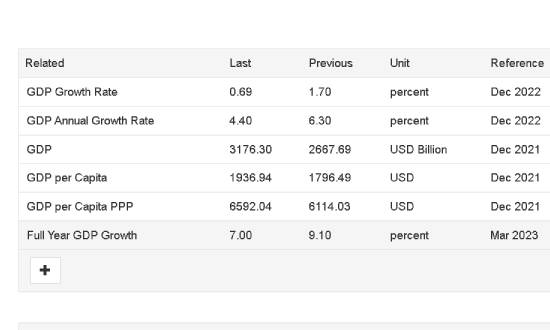

GDP |

$3.737 trillion (nominal; 2023 est.) $13.033 trillion (PPP; 2023 est.) |

|

GDP rank |

5th (nominal; 2023) 3rd (PPP; 2023) |

|

GDP growth |

6.8% (2022) 4.4% (Q3 2022-23) 5.9% (2023f) 6.3% (2024f) |

|

GDP per capita |

$2,601 (nominal; 2023 est.) $9,073 (PPP; 2023 est.) |

Improved labor market conditions and consumer confidence will boost private consumption. The central government’s pledge to boost capital spending in fiscal 2023 will also boost demand, despite aiming to reduce the fiscal deficit to 5.9% of GDP. Services will grow strongly in FY2023 and FY2024, aided by a recovery in tourism and other connected services, as the impact of COVID-19 subsides.However, manufacturing growth in FY2023 is expected to be held back by weaker global demand, but may improve in FY2024. Recent announcements on improving agricultural productivity, such as establishing digital services for crop planning and supporting agricultural start-ups, are important to sustain agricultural growth in the medium term.

Assuming a moderation in oil and food costs, expansion seem moderate to 5% in FY2023 and advance to 4.5% in FY2024 as inflationary weights die down. Growth in stock trades is anticipated to moderate in monetary 2023 some time recently moving forward in 2024, as production-related motivating force programs and endeavors to progress the trade environment, such as simplifying labor directions, progress execution in hardware and other manufacturing growth regions. Solid development in administrations sends out is anticipated to reinforce India’s overall adjust of payments.Strong growth in services sends out is anticipated to fortify India’s in general adjust of installments.