Are you considering contributing in cryptocurrency? Gain essential information about the world of advanced monetary standards and find the focal points of contributing in cryptocurrency. Our comprehensive guide gives valuable bits of knowledge to assist you make educated venture decisions.

Cryptocurrency has emerged as a progressive resource course, captivating the attention of speculators around the world. With its decentralized nature and potential for substantial returns, investing in cryptocurrency has become an attractive option for many. In any case, some time recently jumping into this energizing and dynamic space, it is vital to gain a comprehensive understanding of the basics, dangers, and preferences related with cryptocurrency investments. This article serves as a direct to supply you with essential knowledge and insights into cryptocurrency investment.

Understanding Cryptocurrency

Cryptocurrency is a computerized or virtual form of money that employs cryptography for secure money related exchanges, control the creation of unused units, and verify the transfer of assets. Not at all like traditional fiat currencies issued by central banks, cryptocurrencies operate on decentralized networks called blockchains.

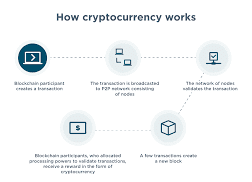

How Cryptocurrency Works

Cryptocurrencies work through a technology called blockchain, which may be a conveyed record that records all transactions over a network of computers. Each transaction is grouped into a block, cryptographically linked to the past block, and added to the chain of exchanges, shaping a straightforward and immutable record.

Advantages of Contributing in Cryptocurrency

Investing in cryptocurrency offers several focal points that have contributed to its growing notoriety among speculators. Here are a few key advantages:

Potential for Tall Returns: Cryptocurrencies have shown noteworthy cost appreciation over time, giving openings for significant returns on speculation. The unstable nature of the advertise permits for potential fast growth.

Diversification: Cryptocurrency ventures offer expansion from conventional resource classes like stocks and bonds. Including cryptocurrencies to your venture portfolio can offer assistance to spread chances and possibly upgrade general returns.

24/7 Advertise Get to: Not at all like conventional monetary markets that operate during particular hours, cryptocurrency markets operate 24/7, permitting investors to exchange at their convenience and respond to showcase developments in real-time.

Decentralization and Security: Cryptocurrencies operate on decentralized systems, making them less defenseless to censorship, extortion, or interference from third parties. The utilization of cryptography ensures secure exchanges and protects users’ identities.

Global Openness: Cryptocurrencies are accessible to anybody with an online connection, irrespective of their topographical area. This inclusivity enables people without traditional banking services to take part in the worldwide economy.

Potential Dangers and Considerations

While cryptocurrency speculations offer alluring points of interest, it is pivotal to be mindful of the potential dangers and considerations:

Market Instability: Cryptocurrency markets are highly unstable, and costs can experience critical variances inside brief periods. Investors must be arranged for cost volatility and potential losses.

Regulatory and Lawful Uncertainty: The administrative scene for cryptocurrencies is advancing, and there’s continuous talk about their classification and treatment. Changes in directions may affect the showcase and investors’ rights and protections.

Security Dangers: Cryptocurrency speculations are helpless to hacking, burglary, and tricks. Legitimate security measures, such as utilizing secure wallets and practicing great cybersecurity propensities, are fundamental to ensure your investments.

Liquidity and Advertise Control: A few cryptocurrencies may have lower liquidity compared to conventional markets, which can affect buying and selling at desired costs.Additionally, the crypto market is helpless to control due to its relatively little size.

Types of Cryptocurrencies

There are thousands of cryptocurrencies available nowadays, each with its unique highlights and purposes. Bitcoin, the primary and most well-known cryptocurrency, paved the way for the development of numerous elective cryptocurrencies, often alluded to as altcoins.

Getting Begun with Cryptocurrency Investment

To get started with cryptocurrency investment, follow these key steps:

Educate Yourself: Learn about different cryptocurrencies, blockchain technology, and venture strategies. Stay educated around advertising trends and developments.

Set Venture Objectives: Characterize your investment goals, hazard tolerance, and time skyline. Determine the amount of capital you’re willing to invest in cryptocurrencies.

Choose a Solid Trade: Select a reputable cryptocurrency exchange to purchase and sell cryptocurrencies. Consider factors such as security measures, client interface, available cryptocurrencies, and fees.

Secure Your Speculations: Utilize secure wallets to store your cryptocurrencies. Equipment wallets or cold capacity choices offer improved security against hacking and theft.

Diversify Your Portfolio: Consider broadening your cryptocurrency property over diverse cryptocurrencies to spread risk.

Best Practices for Investing in Cryptocurrency

Here are some best phones to follow when investing in cryptocurrency:

Do Your Research: Thoroughly research the cryptocurrencies you’re interested in some time recently investing. Understand their innovation, use cases, and potential risks.

Stay Updated: Stay informed about showcase news, administrative improvements, and mechanical advancements related to cryptocurrencies.

Manage Risk: Set realistic desires, differentiate your ventures, and never contribute more than you can manage to lose.

Practice Security: Implement strong security measures, such as using two-factor authentication, solid passwords, and secure wallets.

Seek Proficient Exhortation: Consider counseling with a financial advisor or cryptocurrency expert to get personalized guidance based on your financial objectives and chance tolerance.

Tools and Platforms for Cryptocurrency Investment

Various tools and platforms are available to assist you in your cryptocurrency investment travel. These incorporate cryptocurrency portfolio trackers, exchanging bots, and decentralized finance (DeFi) platforms. Research and choose the tools that adjust with your speculation methodology and goals.

Staying Educated and Overseeing Your Investments

Cryptocurrency markets are dynamic and constantly evolving. Stay updated with market trends, industry news, and regulatory advancements. Frequently audit your speculation portfolio, survey performance, and make necessary adjustments based on your goals and advertise conditions.

Conclusion

Investing in cryptocurrency can be an exciting and possibly profitable wander. Be that as it may, it is basic to approach it with caution and pick up a strong understanding of the fundamentals, risks, and advantages involved. By educating yourself, practicing due diligence, and following the best homes, you’ll be able explore the cryptocurrency, advertise more confidently and make informed venture decisions.

FAQs

What is cryptocurrency and how does it work?

What are the focal points of contributing in cryptocurrency?

What are the risks related with cryptocurrency investments?

How can I get begun with cryptocurrency investment?

Are there any best hones to take after when investing in cryptocurrency?